We employ a research-intensive strategy designed to deliver attractive rates of returns

over the long term. The firm focuses on integrating behavioral finance theories and value-driven

research into our investment approach. Perseus uses fundamental analysis to select deeply

undervalued companies based on a thorough assessment of their business models and philosophy.

In addition to traditional fundamental analysis, the firm focuses on studying the psychology

of institutional and retail investing to identify Heuristic Bias behavior and inefficiencies in the markets.

Additionally, our area of focus includes exploiting opportunities in assets such as Equities, Fixed-Income and Real-Estate.

Systematic Equities

Our equity strategies focus on exploiting inefficiencies in the public equity markets across the globe. Our team evaluates situations from multiple angles and disciplines with the aim of identifying opportunities using systematic analysis. We believe in the longer-term, equity strategies with the focus on factor and value-based investing will outperform broader equity markets on a favorably skewed risk/reward profile.

Systematic Fixed Income

Our Fixed Income strategies focus on complex situations across global corporate and structured credit markets. We seek to capture mispriced investments across disrupted, dislocated, and distressed situations in the Corporate Credit and Structured Credit investment strategies.

Additionally, we believe Corporate Bonds are an important component of every fixed income portfolios because they offer exposure to the credit risk premium. Momentum, value, and other factors exist not only in equities, but we find evidence of their efficacy in the corporate and government bonds.

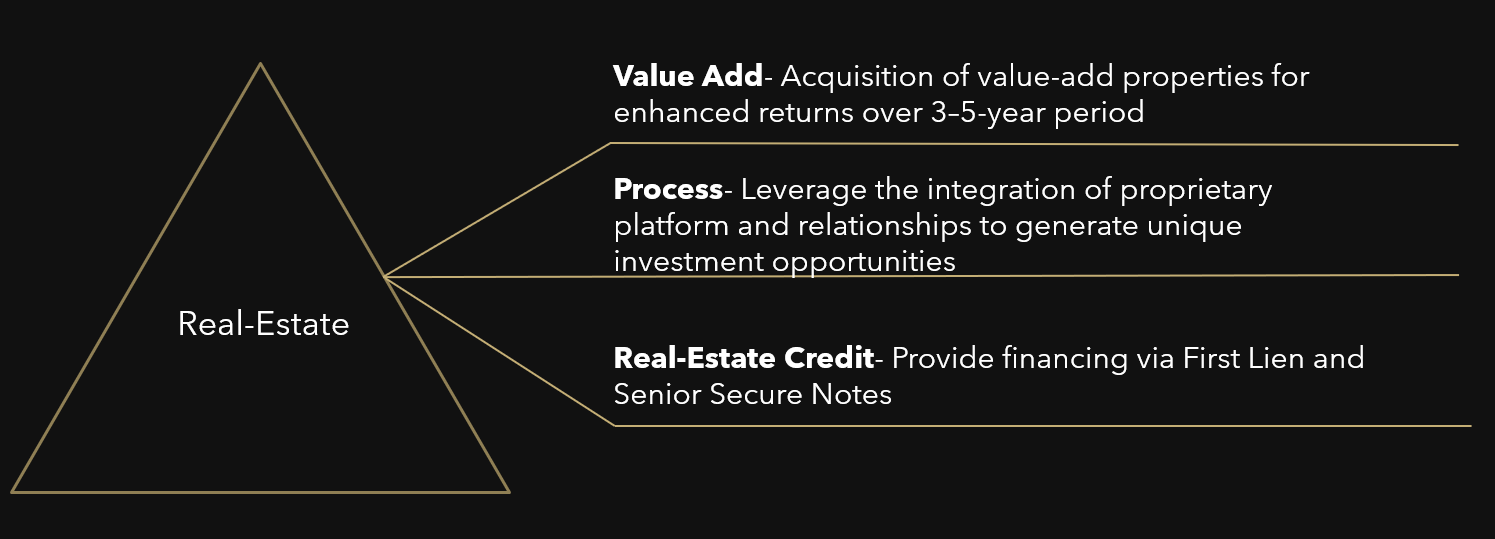

Real Estate

We invest in both opportunistic real estate properties and real estate credit in the United States. Founded in 2020, We raised approximately over $1mm of dedicated real estate capital and have completed multiple transactions across real estate classes.

The integration of our broader platform and relationships provide us with a competitive advantage that enhances our ability to generate unique investment opportunities and improves access to proprietary transaction networks that are less accessible by traditional real estate investors.